Shiba Inu Price Prediction: SHIB long-term speculators aim for $0.00005336

Shiba Inu price is preparing for a significant uptick following the formation of a bullish chart pattern. However, SHIB must slice above multiple obstacles ahead in order to validate the optimistic technical pattern.

Shiba Inu price is forming an ascending triangle pattern on the daily chart, which projects a 51% ascent from the topside trend line of the governing technical pattern toward $0.00005336.

Shiba Inu price must overcome multiple challenges before the bullish target would be put on the radar. The first hurdle will emerge at the 38.2% Fibonacci retracement level, coinciding with the 50-day Simple Moving Average (SMA) at $0.00002561.

Additional obstacles may appear at the 50% retracement level at $0.00002826, intersecting with the 21-day SMA and the 200-day SMA.

Shiba Inu price will face further resistance at the 100-day SMA at $0.00003169 before SHIB bulls attempt to reach the upper boundary of the prevailing chart pattern at $0.00003468, coinciding with the 78.6% Fibonacci retracement level.

If Shiba Inu price manages to slice above the aforementioned level of resistance, the 51% climb toward $0.00005336 could be in the offing.

SHIB/USDT daily chart

If selling pressure increases, Shiba Inu price could test the lower boundary of the governing technical pattern at $0.00002368. If bearish sentiment continues to increase, SHIB could fall toward the 23.6% Fibonacci retracement level at $0.00002233.

However, if Shiba Inu price slices below the downside trend line of the prevailing chart pattern, the bullish chart pattern may be invalidated.

Shiba Inu price could continue tumbling toward the January 26 low at $0.00001990, then toward the January 22 low at $0.00001672.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Shiba Inu Price Prediction: SHIB upside potential capped at $0.0000251

Shiba Inu price has sliced through significant support levels during its recent flash crash and is currently consolidating. Going forward, investors can expect SHIB to see a relief rally emerging off the immediate foothold.

Shiba Inu price has been on a non-stop downtrend since its all-time high on October 28, 2021. The downswing has shattered several support levels and is currently testing the 9-hour demand zone, extending from $0.0000158 to $0.0000193.

Investors can expect Shiba Inu price to stay above this foothold and see a breakout from the current consolidation, favoring the bulls. The resulting uptrend is likely to be capped at the 200-day Simple Moving Average (SMA) at $0.0000251.

Although unlikely, this 25% upswing could extend to 38% as it retests the weekly resistance barrier at $0.0000283, roughly coinciding with the 50-day SMA at $0.0000297.

SHIB/USDT 9-hour chart

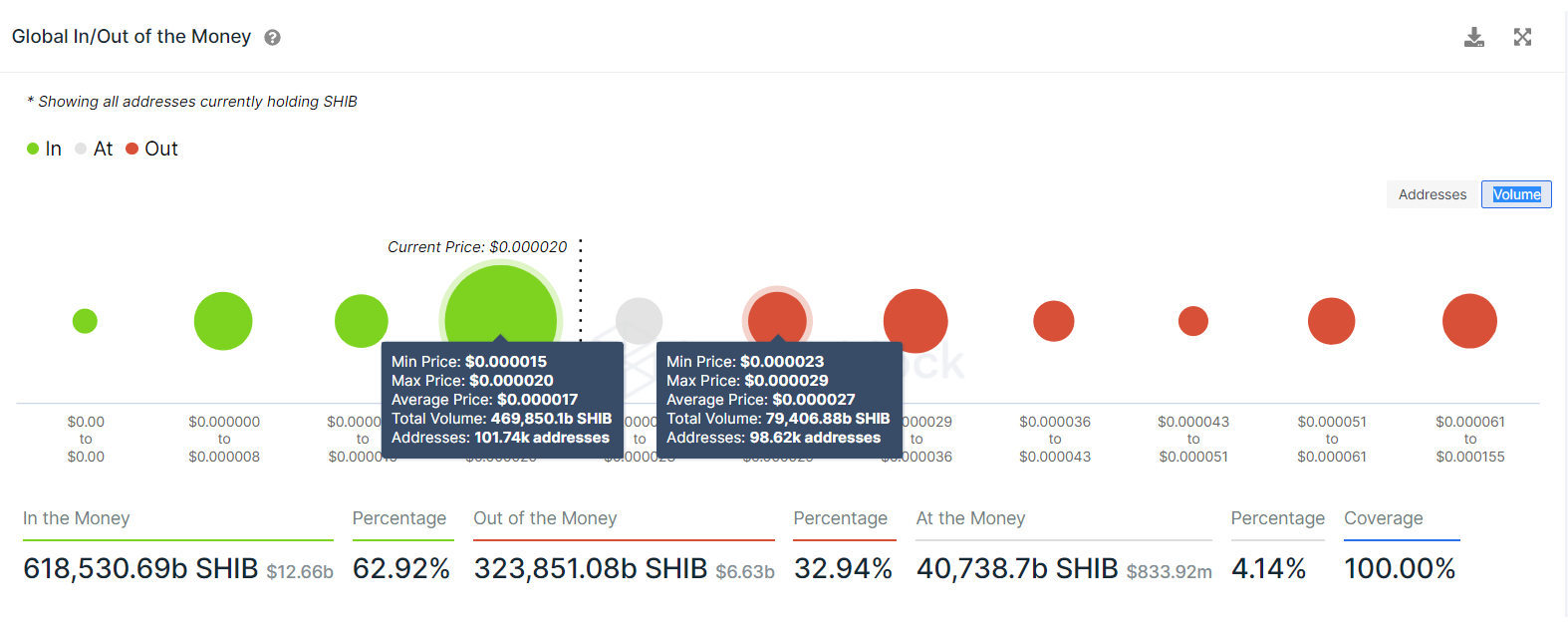

Supporting a bounce from the said demand zone for Shiba Inu price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This on-chain index shows that roughly 101,740 addresses that purchased 469,850 billion SHIB tokens at an average price of $0.0000170 are present below.

Therefore, any minor selling pressure will be absorbed by these investors wanting to accumulate more.

SHIB GIOM

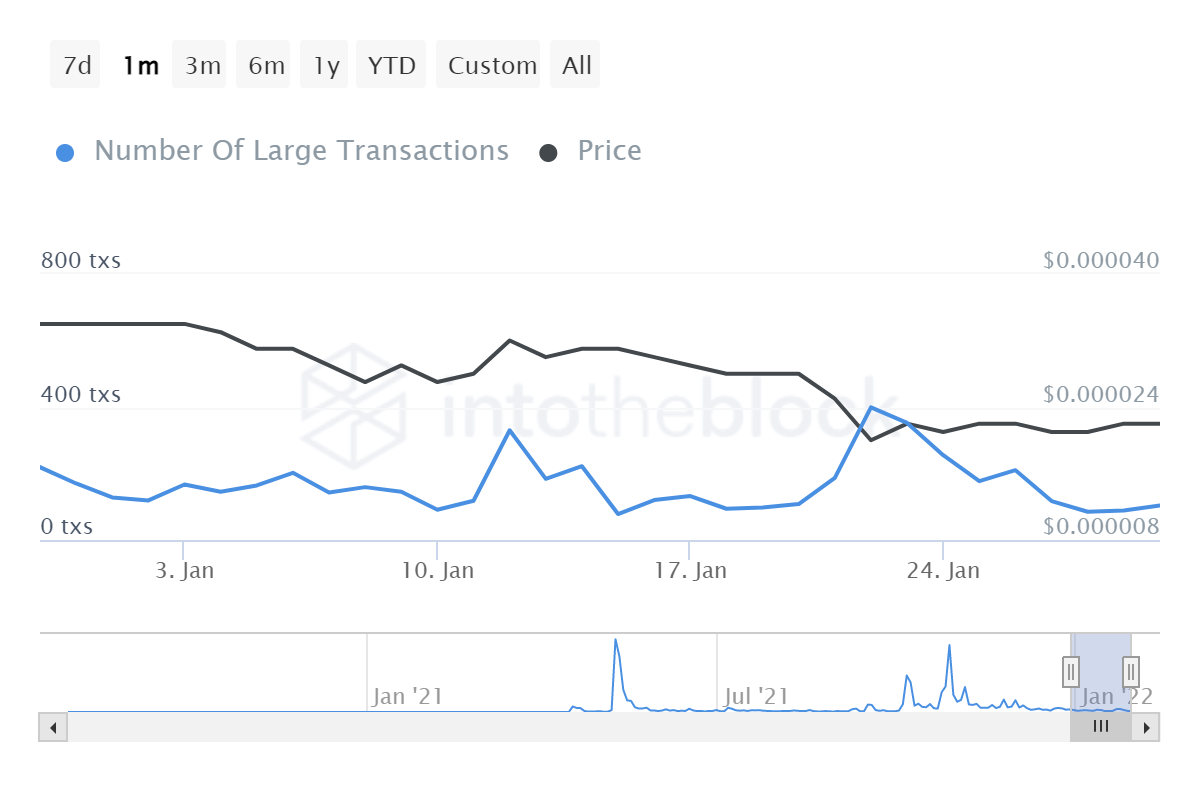

While things are looking up for Shiba Inu price, the number of large transactions worth $100,000 or more seems to be on a downtrend over the past three months. Such transfers have almost halved from 219 to 104, indicating that these investors are not interested in SHIB at the current price levels.

SHIB large transactions

A daily candlestick close below the $0.0000158 to $0.0000193 demand zone will create a lower low and put a large number of holders in this area, “Out of the Money.” If these investors decide to offload their holdings, it will create massive selling pressure, invalidating the bullish thesis for SHIB. This development could see Shiba Inu price fill the fair value gap and retest the eight-decimal support at $0.00000787.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Post a Comment